NVIDIA (NVDA) Stock Analysis

Investment Recommendation

Based on comprehensive analysis of NVIDIA's financial performance, technical indicators, competitive position, and analyst sentiment, we recommend a BUY rating for NVIDIA Corporation (NVDA) stock.

Key Investment Highlights

- Dominant Market Position: NVIDIA commands 70-95% of the AI GPU market, creating a strong competitive moat.

- Exceptional Financial Performance: Record revenue of $130.5 billion in FY2025 (up 114% YoY) with industry-leading 75% gross margins.

- Strong Growth Trajectory: Data Center segment grew 142% YoY to $115.2 billion, driven by accelerating AI adoption.

- Positive Technical Indicators: Price trends and momentum indicators suggest continued bullish momentum.

- Favorable Analyst Sentiment: Overwhelming Buy/Overweight ratings with average price target representing significant upside potential.

Investment Risks

- Valuation Concerns: Premium valuation multiples leave little room for execution missteps.

- Increasing Competition: AMD, Intel, and cloud providers developing their own AI chips could erode market share.

- Customer Concentration: High dependence on major cloud providers creates risk if they shift to alternatives.

- Cyclicality: Potential slowdown in AI infrastructure buildout could impact growth rates.

Financial Snapshot

Latest Quarter Revenue

$39.3 billion

↑ 78% YoY

Annual Revenue (FY2025)

$130.5 billion

↑ 114% YoY

Gross Margin

75.0%

EPS (FY2025)

$2.94

↑ 147% YoY

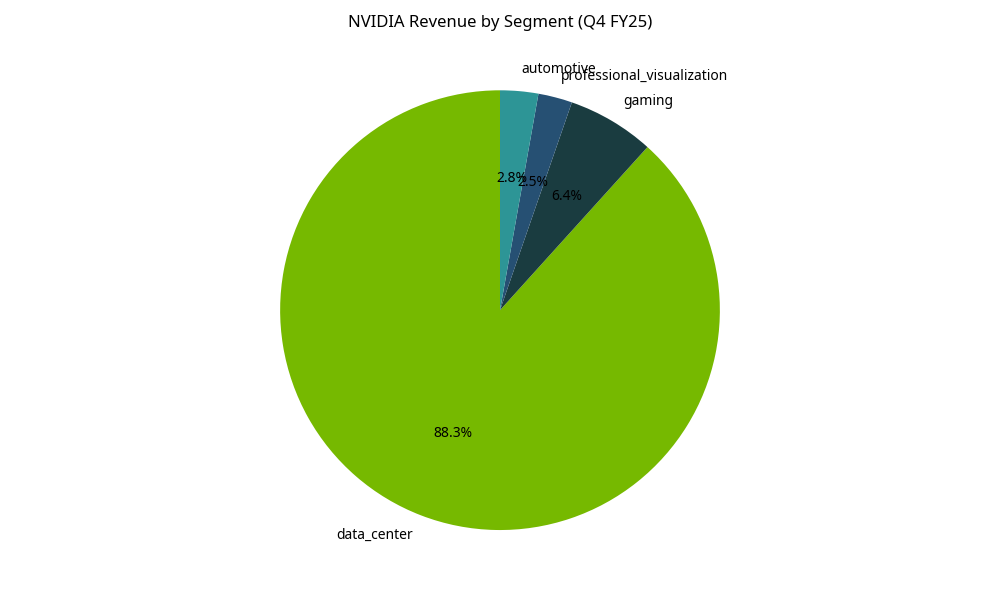

Revenue by Segment

Outlook

NVIDIA is well-positioned to benefit from the continued expansion of AI adoption across industries. The company's technological leadership, strong ecosystem, and new product cycles (particularly the Blackwell architecture) provide a solid foundation for sustained growth.

While competition is intensifying, NVIDIA's first-mover advantage, software ecosystem, and continuous innovation should allow it to maintain its leadership position in the AI computing market.

Investors should monitor valuation metrics, competitive developments, and any signs of slowdown in AI infrastructure spending as potential risk factors.

Explore Detailed Analysis

This executive summary provides an overview of our NVIDIA stock analysis. For more detailed information, please explore the following sections:

Price History

Historical price trends and performance metrics

Technical Analysis

Technical indicators and market position

Fundamentals

Financial performance and business analysis

Ownership

Insider trading and institutional holdings

Analyst Coverage

Analyst ratings and price targets

Conclusion

Final assessment and investment strategy