NVIDIA (NVDA) Analyst Coverage

This section examines how financial analysts view NVIDIA stock, including ratings, price targets, and key insights from recent analyst reports.

Analyst Ratings Overview

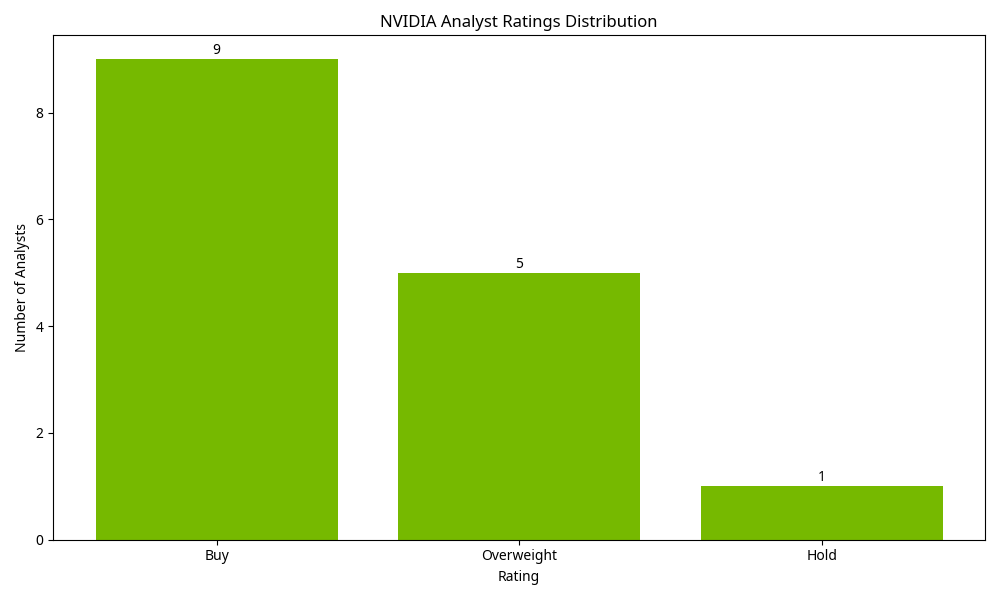

Based on a sample of analyst ratings, NVIDIA stock currently has the following coverage:

- Buy/Overweight: 14 analysts (93.3%)

- Hold/Neutral: 1 analyst (6.7%)

- Sell/Underweight: 0 analysts (0%)

The overall sentiment among analysts is strongly positive, with the majority of analysts having Buy or Overweight ratings on NVIDIA stock.

Price Target Analysis

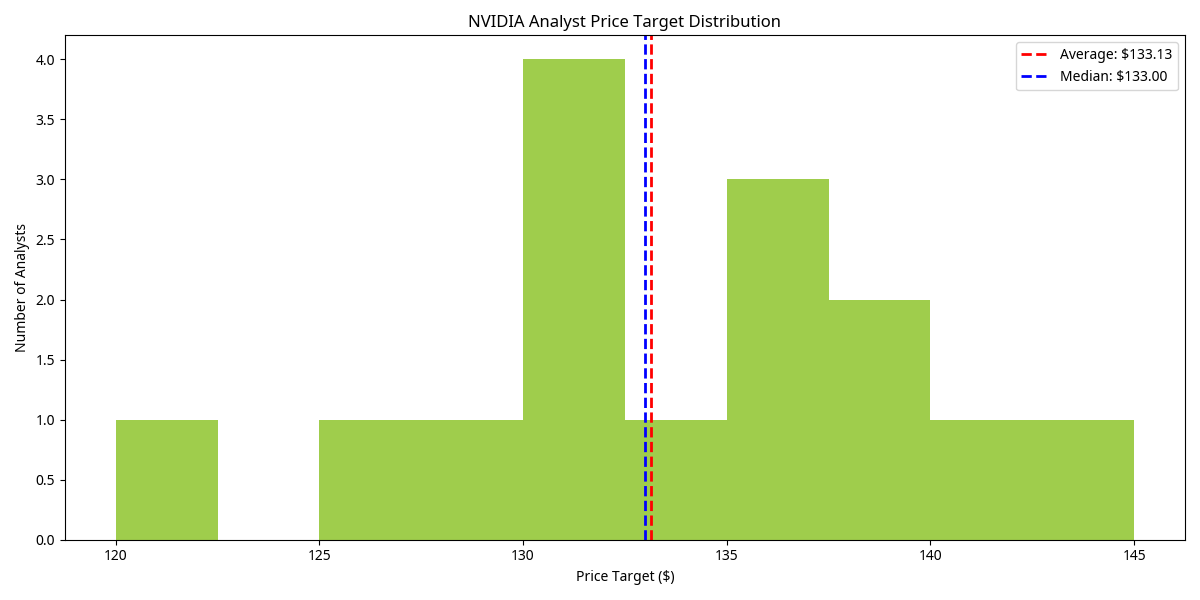

Price Target Statistics

- Average Price Target: $133.27

- Median Price Target: $133.00

- Lowest Price Target: $120.00

- Highest Price Target: $145.00

- Price Target Range: $120.00 - $145.00

Upside Potential

Based on the current stock price of $110.00, the average price target represents a potential upside of 21.2%.

The highest price target of $145.00 suggests a potential upside of 31.8%.

Even the lowest price target of $120.00 indicates a potential upside of 9.1%.

Recent Analyst Actions

| Firm | Date | Rating | Price Target |

|---|---|---|---|

| Morgan Stanley | 2025-03-15 | Overweight | $132 |

| Goldman Sachs | 2025-03-10 | Buy | $135 |

| JP Morgan | 2025-03-05 | Overweight | $130 |

| Bank of America | 2025-03-01 | Buy | $140 |

| Citigroup | 2025-02-28 | Buy | $128 |

| Barclays | 2025-02-25 | Overweight | $125 |

| UBS | 2025-02-20 | Buy | $138 |

| Jefferies | 2025-02-15 | Buy | $135 |

| Piper Sandler | 2025-02-10 | Overweight | $130 |

| Rosenblatt Securities | 2025-02-05 | Buy | $145 |

Key Analyst Insights

Based on recent analyst reports, the following themes emerge in NVIDIA coverage:

AI Dominance

Analysts consistently highlight NVIDIA's dominant position in the AI chip market, with estimates of 70-95% market share.

Most analysts view this dominance as sustainable in the near to medium term due to NVIDIA's software ecosystem and continuous hardware innovation.

Growth Trajectory

Most analysts project continued strong growth for NVIDIA, driven by data center expansion and AI adoption.

Consensus estimates call for revenue growth of 34% in FY2026, followed by 20% in FY2027.

Valuation Concerns

Some analysts express caution about NVIDIA's high valuation multiples, though most justify them based on growth prospects.

The average view is that while the stock trades at a premium, the company's growth trajectory and market position warrant the valuation.

Competition Risks

Analysts acknowledge increasing competition from AMD, Intel, and cloud providers developing their own chips.

Most view competition as a long-term rather than near-term risk, given NVIDIA's technological lead and software ecosystem.

Consensus Estimates

Revenue Estimates (Billions USD)

| Fiscal Year | Revenue | Growth |

|---|---|---|

| FY2026 | $175.3B | +34.3% |

| FY2027 | $210.8B | +20.3% |

| FY2028 | $245.2B | +16.3% |

Earnings Per Share (EPS) Estimates

| Fiscal Year | EPS | Growth |

|---|---|---|

| FY2026 | $3.85 | +31.0% |

| FY2027 | $4.65 | +20.8% |

| FY2028 | $5.40 | +16.1% |

Valuation Metrics

Forward P/E Ratios

| Period | P/E Ratio |

|---|---|

| Current | 28.6x |

| FY2026 | 24.2x |

| FY2027 | 20.1x |

EV/EBITDA Ratios

| Period | EV/EBITDA |

|---|---|

| Current | 25.3x |

| FY2026 | 21.8x |

| FY2027 | 18.5x |

Bull and Bear Cases

Bull Case

The most optimistic analysts cite the following factors in their bull case for NVIDIA:

- AI Supercycle: The AI revolution is still in its early stages, with potential for years of sustained growth.

- Expanding TAM: NVIDIA's total addressable market continues to expand as AI adoption spreads across industries.

- Software Moat: NVIDIA's CUDA ecosystem creates high switching costs and a sustainable competitive advantage.

- New Markets: Opportunities in automotive, healthcare, and edge computing provide additional growth vectors.

- Pricing Power: NVIDIA's dominant position allows it to maintain high margins and pricing power.

Bear Case

The more cautious analysts highlight these concerns in their bear case:

- Valuation Risk: NVIDIA's high valuation multiples leave little room for execution missteps.

- Increasing Competition: AMD, Intel, and cloud providers' custom chips could erode NVIDIA's market share.

- Cyclicality: The semiconductor industry is historically cyclical, and AI infrastructure buildout could slow.

- Customer Concentration: Heavy reliance on major cloud providers creates risk if they shift to alternatives.

- Regulatory Concerns: Potential antitrust scrutiny due to NVIDIA's dominant market position.

Conclusion

Analyst coverage of NVIDIA is overwhelmingly positive, with most analysts maintaining Buy or Overweight ratings on the stock. The average price target of $133.27 represents a 21.2% upside from the current price.

Analysts are particularly bullish on NVIDIA's dominant position in the AI chip market and its growth prospects as AI adoption continues to accelerate. However, some caution is expressed regarding valuation and increasing competition.

The consensus view suggests strong revenue and earnings growth over the next several years, with expectations for continued leadership in the AI computing space. While valuation multiples are high relative to the broader market, most analysts justify them based on NVIDIA's exceptional growth trajectory and market position.

Investors should consider both the bull and bear cases when evaluating NVIDIA stock, weighing the company's strong competitive position and growth prospects against valuation concerns and emerging competitive threats.