NVIDIA (NVDA) Fundamental Analysis

This section examines NVIDIA's business model, financial performance, growth trends, and competitive position to provide a comprehensive fundamental analysis of the company.

Company Overview

NVIDIA Corporation is a leading technology company specializing in the design and manufacturing of graphics processing units (GPUs) and system-on-a-chip units (SoCs) for various markets including gaming, professional visualization, data centers, and automotive.

Founded in 1993 by Jensen Huang, Chris Malachowsky, and Curtis Priem, NVIDIA has transformed from a graphics chip company to a dominant force in artificial intelligence computing. The company is headquartered in Santa Clara, California, USA.

NVIDIA's mission statement is "to transform how the world experiences computing."

Business Model

NVIDIA's business model revolves around designing and selling specialized GPUs and related technologies. The company operates through several key segments:

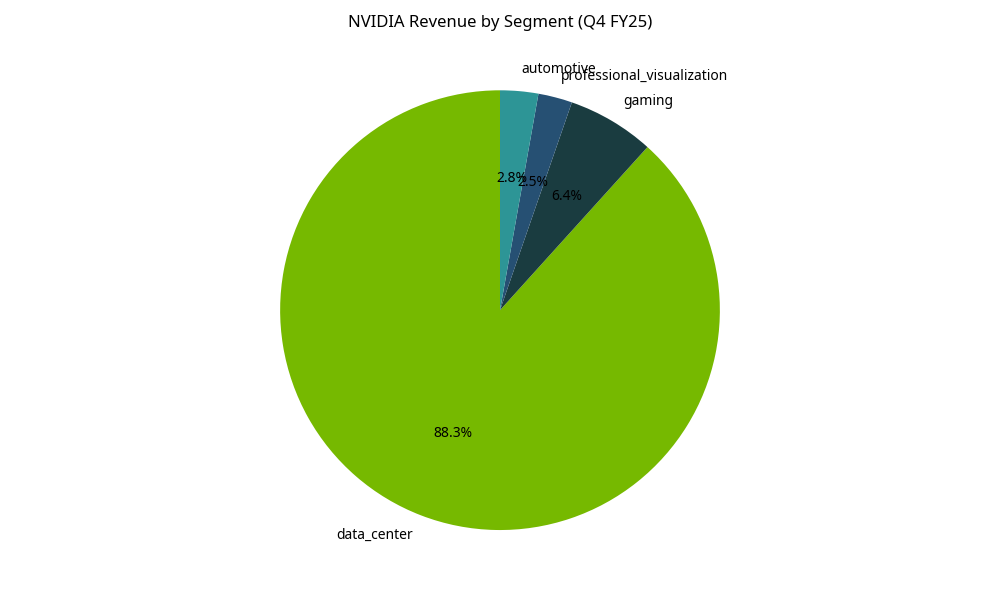

Revenue by Segment

Data Center (88.3% of revenue)

AI and high-performance computing GPUs and systems

- H100, H200, and Blackwell GPUs for AI training and inference

- DGX systems for enterprise AI

- Networking solutions (Mellanox)

Gaming (6.4% of revenue)

GeForce GPUs for gaming and RTX technology

- GeForce RTX GPUs for PC gaming

- GeForce NOW cloud gaming service

- Gaming software and technologies

Professional Visualization (2.5% of revenue)

Quadro/RTX GPUs for workstations

- Workstation GPUs for design professionals

- Visualization software

- Virtual reality solutions

Automotive (2.8% of revenue)

DRIVE platform for autonomous vehicles

- DRIVE AGX platform for autonomous driving

- DRIVE software stack

- Automotive partnerships

NVIDIA's revenue streams include:

- Hardware Sales: Direct sales of GPUs and systems to consumers, enterprises, and OEMs

- OEM and IP Licensing: Licensing intellectual property to other companies

- Software and Services: CUDA platform, AI software, and developer tools

Financial Performance

Latest Quarter (Q4 FY25)

Revenue

$39.3 billion

↑ 12% QoQ, ↑ 78% YoY

Gross Margin

73.0%

Net Income

$22.1 billion

EPS

$0.89

↑ 82% YoY

Data Center Revenue

$35.6 billion

↑ 93% YoY

Gaming Revenue

$2.5 billion

↓ 11% YoY

Fiscal Year 2025

Revenue

$130.5 billion

↑ 114% YoY

Gross Margin

75.0%

Net Income

$72.9 billion

EPS

$2.94

↑ 147% YoY

Data Center Revenue

$115.2 billion

↑ 142% YoY

Gaming Revenue

$11.4 billion

↑ 9% YoY

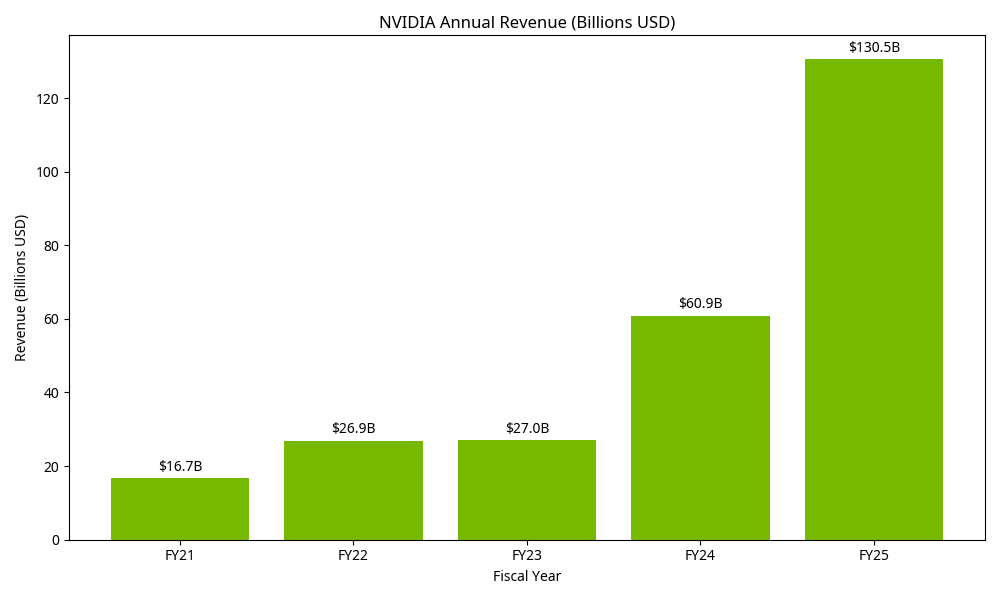

Growth Trends

Revenue Growth

NVIDIA has experienced explosive growth, particularly in its Data Center segment, driven by the surge in AI adoption. Key growth metrics include:

- Revenue Growth: 114% year-over-year increase in FY25

- Data Center Growth: 142% year-over-year increase in FY25

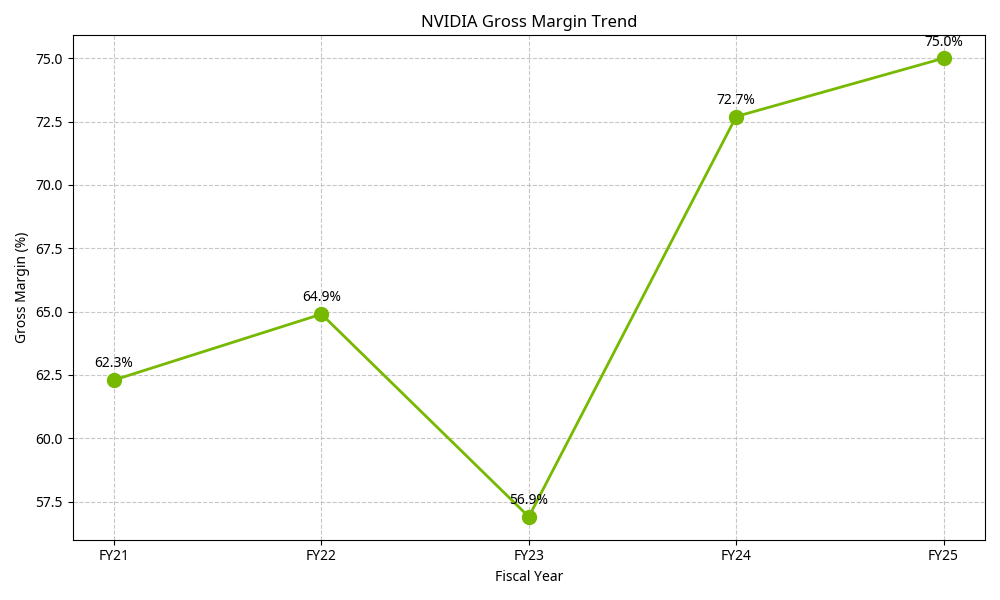

- Gross Margin Expansion: Increased from 72.7% in FY24 to 75.0% in FY25

Gross Margin Trend

The company's growth is primarily driven by:

- AI Adoption: Increasing demand for GPUs in AI training and inference

- Cloud Computing: Major cloud providers expanding their AI infrastructure

- New Product Cycles: Introduction of new GPU architectures like Blackwell

- Software Ecosystem: CUDA platform and AI software tools strengthening NVIDIA's position

Competitive Position

NVIDIA dominates the AI chip market with an estimated 70-95% market share. The company's competitive advantages include:

- First-Mover Advantage: Early focus on GPU computing and AI acceleration

- Software Ecosystem: CUDA platform and developer tools create high switching costs

- R&D Investment: Continuous innovation in GPU architecture and AI technologies

- Manufacturing Partnerships: Strong relationships with semiconductor manufacturers

Key Competitors

Traditional Chipmakers

- AMD (MI300X)

- Intel (Gaudi)

Cloud Providers

- Google (TPUs)

- AWS (Inferentia/Tranium)

- Microsoft (Maia/Cobalt)

Startups

- Cerebras

- SambaNova

- Graphcore

Despite NVIDIA's dominant position, competition is intensifying from:

- Traditional Chipmakers: AMD and Intel developing competitive AI accelerators

- Cloud Providers: Google, AWS, and Microsoft developing custom AI chips

- Startups: New entrants focusing on specialized AI workloads

Strengths and Weaknesses

Strengths

- Market Leadership: Dominant position in AI and gaming GPU markets

- High Margins: Industry-leading gross margins of 75%

- Software Ecosystem: CUDA platform creates high switching costs

- Innovation: Continuous advancement in GPU architecture

- Strong Management: Visionary leadership under Jensen Huang

Weaknesses

- Customer Concentration: High dependence on major cloud providers

- Competition: Increasing competition from both established players and startups

- Cyclicality: Exposure to semiconductor industry cycles

- High Valuation: Trading at premium multiples compared to peers

- Supply Chain Risks: Dependence on semiconductor manufacturing partners

Recent Developments

- Blackwell Architecture: Next-generation AI chips with significant performance improvements, expected to drive the next wave of growth

- Cloud Partnerships: Expanded relationships with major cloud providers for AI infrastructure

- Stargate Project: Partnership in the $500 billion Stargate Project for advanced computing

- AI Blueprints and NIM: New software tools for building AI agents and applications

- GeForce RTX 50 Series: New gaming GPUs based on the Blackwell architecture

Conclusion

NVIDIA has established itself as the dominant player in the AI chip market, with exceptional financial performance and growth. The company's strong competitive position, high margins, and continuous innovation provide a solid foundation for future growth.

However, increasing competition, customer concentration, and high valuation present risks that investors should consider. The company's ability to maintain its technological edge and expand into new markets will be crucial for sustaining its growth trajectory.

Overall, NVIDIA's fundamental analysis reveals a company with strong financial health, market leadership, and significant growth potential in the expanding AI market.