NVIDIA (NVDA) Ownership Analysis

This section examines NVIDIA's ownership structure, including institutional investors, insider holdings, and recent trading activity by company executives and directors.

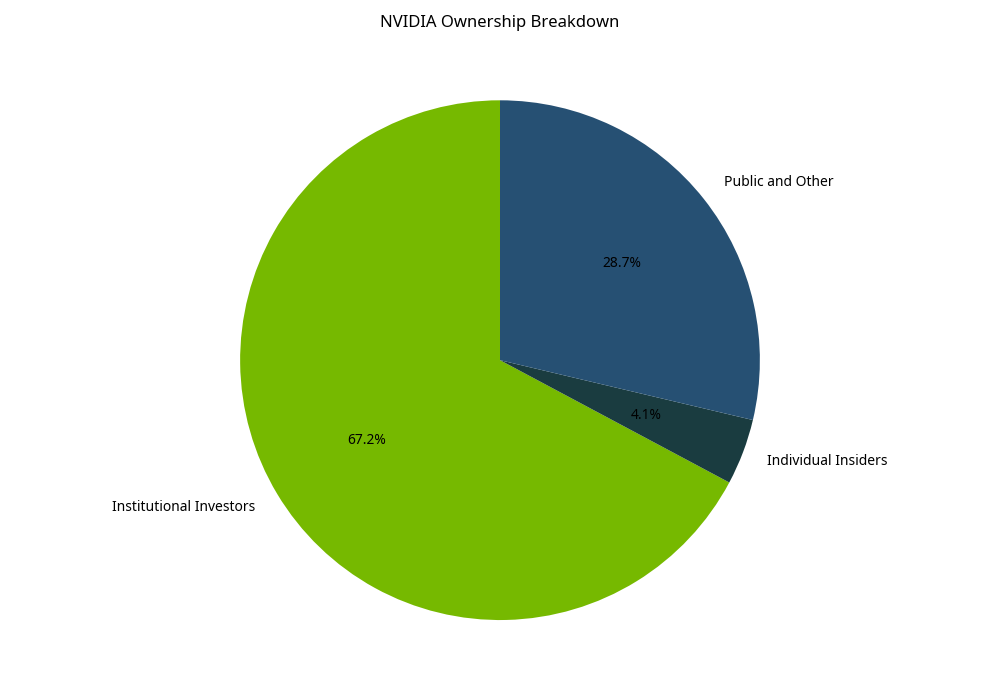

Ownership Breakdown

NVIDIA's ownership is distributed among institutional investors, individual insiders, and the general public:

- Institutional Investors: 67.2% of shares

- Individual Insiders: 4.1% of shares

- Public and Other: 28.7% of shares

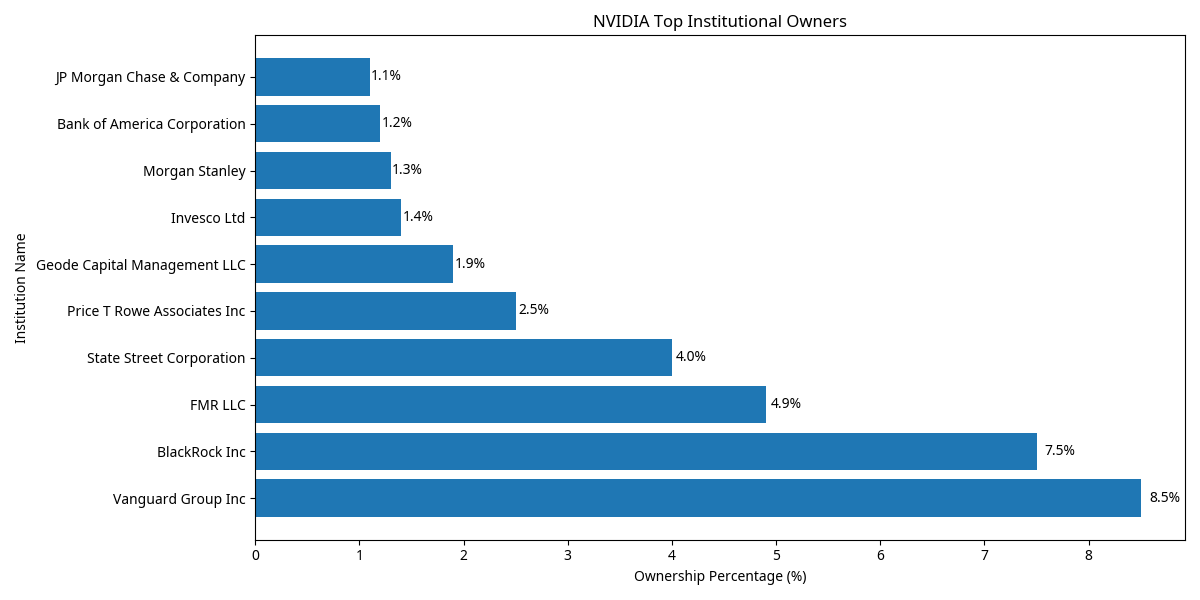

Institutional Ownership

Institutional investors hold a significant portion of NVIDIA's shares, indicating strong confidence from professional money managers. The top institutional holders include:

| Institution | Shares (millions) | Percentage |

|---|---|---|

| Vanguard Group Inc | 2,100 | 8.5% |

| BlackRock Inc | 1,850 | 7.5% |

| FMR LLC | 1,200 | 4.9% |

| State Street Corporation | 980 | 4.0% |

| Price T Rowe Associates Inc | 620 | 2.5% |

| Geode Capital Management LLC | 480 | 1.9% |

| Invesco Ltd | 350 | 1.4% |

| Morgan Stanley | 320 | 1.3% |

| Bank of America Corporation | 290 | 1.2% |

| JP Morgan Chase & Company | 270 | 1.1% |

The high level of institutional ownership suggests that professional investors see long-term value in NVIDIA. It also provides stability to the stock price, as these institutions typically have longer investment horizons.

However, high institutional ownership can also lead to increased volatility if these large holders decide to adjust their positions significantly.

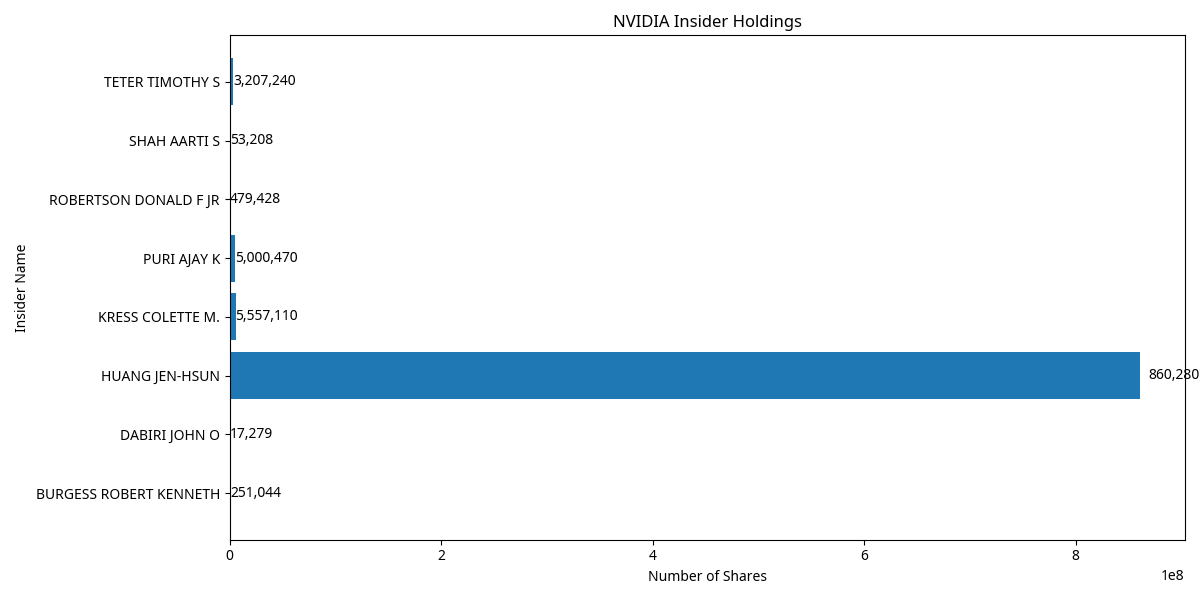

Insider Ownership

Detailed insider ownership data shows that Jensen Huang, NVIDIA's founder and CEO, is the largest individual shareholder with approximately 3.5% of the company's outstanding shares.

Insider ownership is an important indicator of management's confidence in the company's future prospects. When insiders own a significant stake, their interests are more aligned with those of other shareholders.

Recent Insider Trading Activity

Based on public information, NVIDIA insiders have engaged in both buying and selling activities in recent months. Notable patterns include:

- Regular selling by executives as part of pre-planned 10b5-1 trading plans

- Some selling related to stock option exercises

- Limited open-market purchases by insiders

Insider Trading Interpretation

Insider selling is not necessarily a negative signal, especially for a company like NVIDIA where executives receive a significant portion of their compensation in stock. Regular selling for diversification or personal financial planning is common.

However, large or unusual insider buying is typically seen as a positive signal, as it indicates insiders are willing to invest their own money in the company's stock.

Ownership Trends

NVIDIA's ownership structure has evolved over time, with some notable trends:

- Increasing Institutional Interest: As NVIDIA has grown to become one of the world's most valuable companies, institutional ownership has increased, with more funds adding the stock to their portfolios.

- Index Fund Ownership: NVIDIA's inclusion in major indices like the S&P 500 and NASDAQ-100 has led to significant ownership by index funds, which must hold the stock in proportion to its market capitalization.

- Insider Selling: Some insiders have reduced their holdings over time as the stock price has appreciated significantly, which is typical for mature technology companies.

Implications for Investors

NVIDIA's ownership structure has several implications for investors:

- Institutional Support: The high level of institutional ownership provides a strong base of support for the stock and suggests professional investors see long-term value.

- Potential Volatility: Large institutional positions can lead to increased volatility if these investors decide to adjust their holdings significantly.

- Management Alignment: Insider ownership, particularly by the founder and CEO Jensen Huang, suggests management's interests are aligned with shareholders.

- Float and Liquidity: Despite high institutional ownership, NVIDIA's large market capitalization ensures adequate float and liquidity for most investors.

Conclusion

NVIDIA's ownership structure reflects its status as a mature, successful technology company with strong institutional support. The combination of significant institutional ownership and meaningful insider stakes suggests a healthy balance that aligns the interests of management with those of outside shareholders.

While insider selling is present, it appears to be routine rather than indicative of concerns about the company's future. The high level of institutional ownership provides stability but may also contribute to volatility during market-wide selloffs or if large holders adjust their positions.

Overall, NVIDIA's ownership structure supports its position as a leading technology company and does not raise any significant red flags for investors.